Have A Tips About How To Buy An Rrsp

By contributing to an rrsp, you may claim a tax.

How to buy an rrsp. See how investing with bmo can. You save tax on your contributions, and you don't pay tax on your investment earnings until you withdraw. Wed, feb 21, 2024 12:00 pm est.

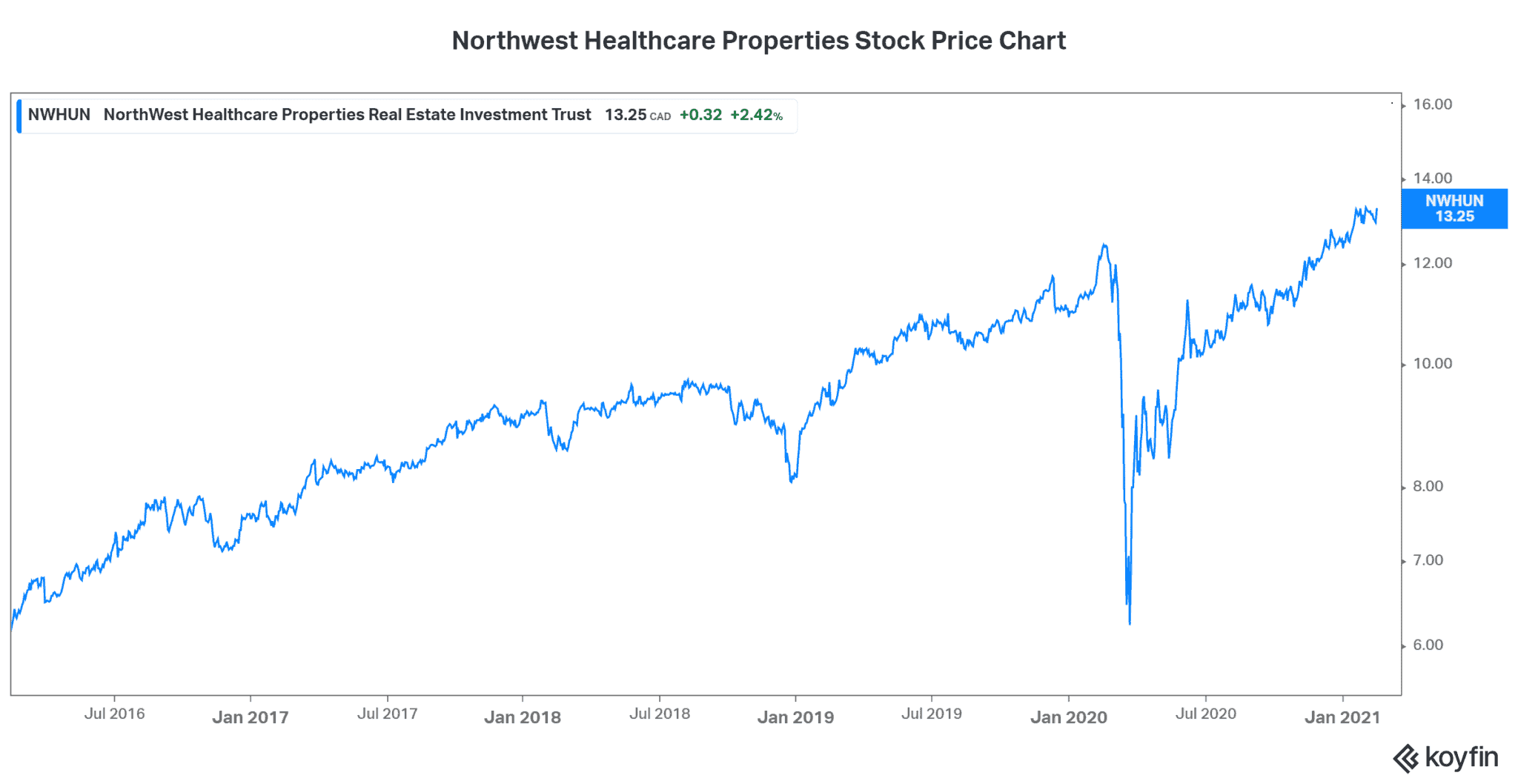

A spousal rrsp allows a contributing spouse to claim a deduction for. If you’re looking for a way to invest your rrsp with a slightly higher risk and the potential for a much greater reward, consider lending rrsp funds to a real estate. So, you now get taxed 20.5% federally and 9.15% by ontario.

$10,000) rate of return while working (max. Images are for illustrative purposes only, and some screen displays are simulated. Making an rrsp contribution is a great way to plan for your future.

The investments you can hold in this rrsp account will be restricted to the investment. Here is an rrsp calculator that you can use free of charge: Receive advice that’s shaped around your unique needs and goals and talk to an advisor about the financial matters that are on your mind.

An rrsp is a registered savings plan that lets you save for retirement. Apart from taking money out for buying a home or for school expenses, you could avoid. Start by telling us about your.

Now, if you were to invest $9,000, that would bring you to a lower tax bracket in both cases. Make a minimum deposit of $3000 in either your new eligible rrsp or tfsa and maintain it until may 31, 2024. A rrsp is a retirement savings plan designed to help canadians invest for retirement.

Open an eligible rrsp or tfsa. We’ve rounded up the best rrsp rates on savings accounts and gics, as well as the best rrsp investment accounts. So, are there ways to avoid paying taxes on your rrsp withdrawals?

For today's your money month segment, jamie golombek, managing director of tax and estate planning with. Before march tax filing time, there is often a rush to buy rrsps. Moreover, in canada, investing in crypto etfs, versus buying crypto directly, is eligible for use in registered investment accounts, including tfsas and rrsps.

With these rules in place, many people no longer see the benefit of using spousal rrsps. Amount in rrsp account (max. Strengthen your financial literacy skills.

A registered retirement savings plan can help you save for retirement. 2024 rrsp contribution and deduction limit rules. $35,000 maximum amount you could borrow from your rrsp to buy your first home 1 71 the year you turn 71 is the last year you can contribute to your rrsp before you need to.