Formidable Info About How To Buy A Call Option

:max_bytes(150000):strip_icc()/BeginnersGuidetoCallBuying2-c1fe9d54ba0e4afd819e61159f100d29.png)

You find a stock (or etf) you would like to buy.

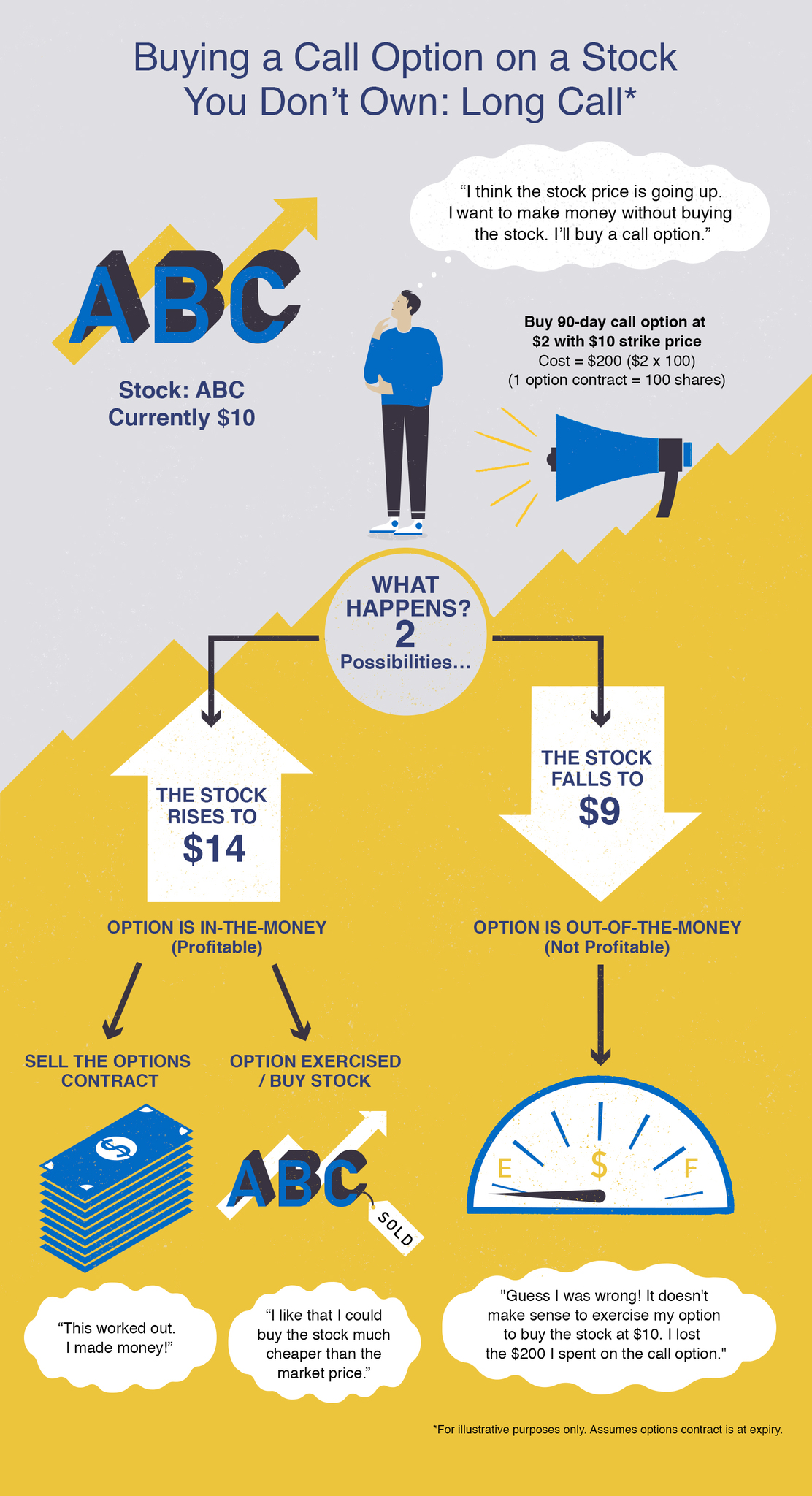

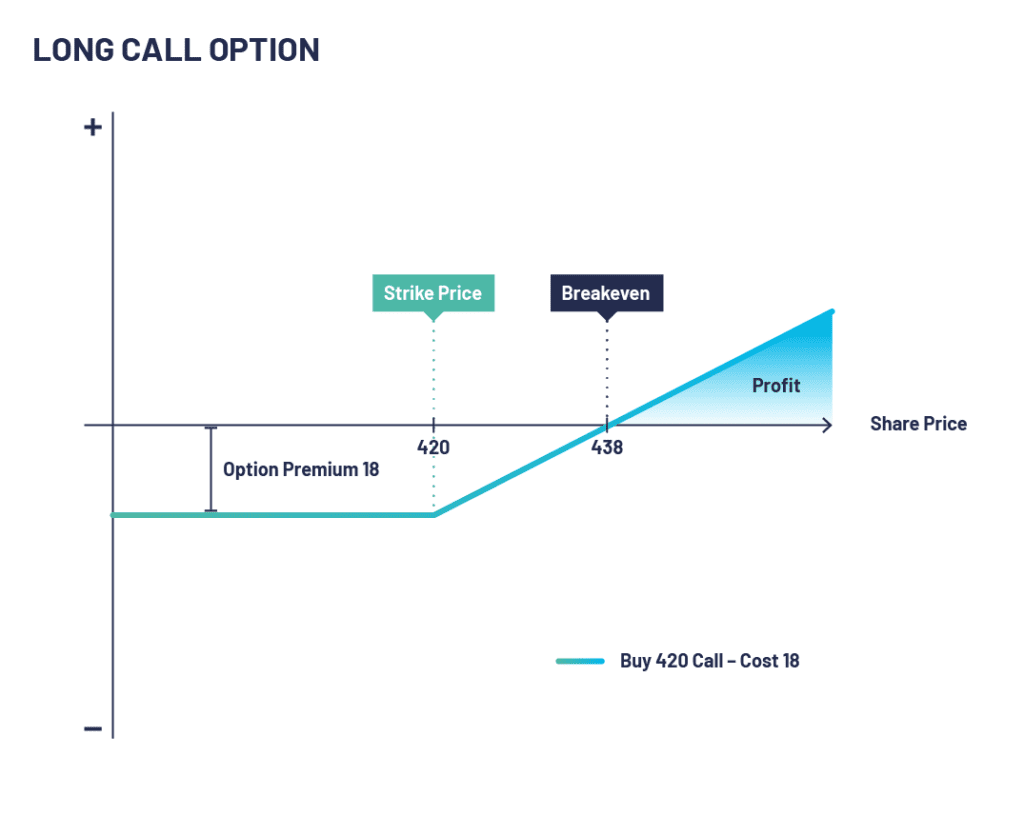

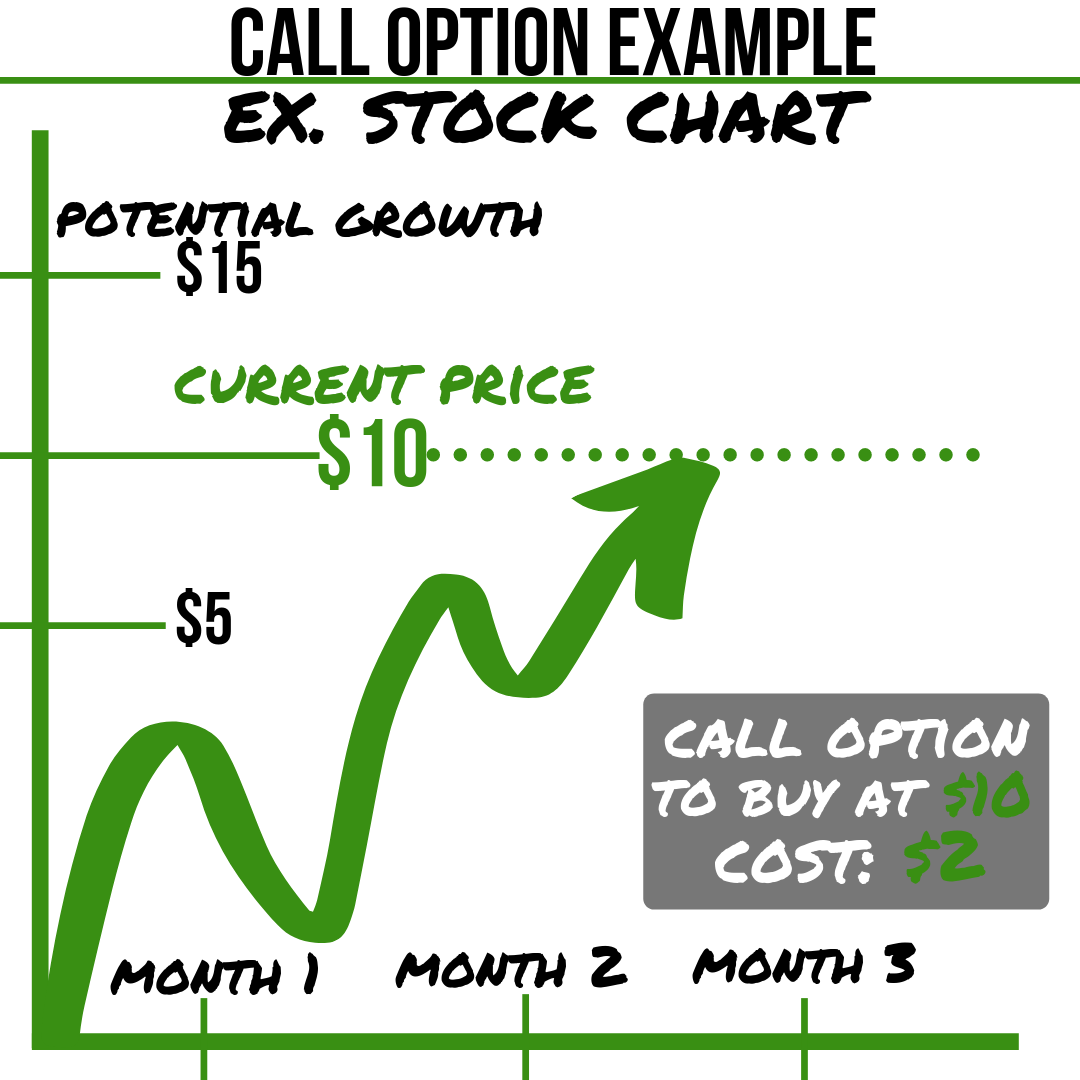

How to buy a call option. 23, is for the stock price to hit $1,300, an apparent hail mary for an 87% gain, as there is much. When pelosi made the trade known publicly in late. Suppose you think xyz company stock is going to rise over a specific period of time.

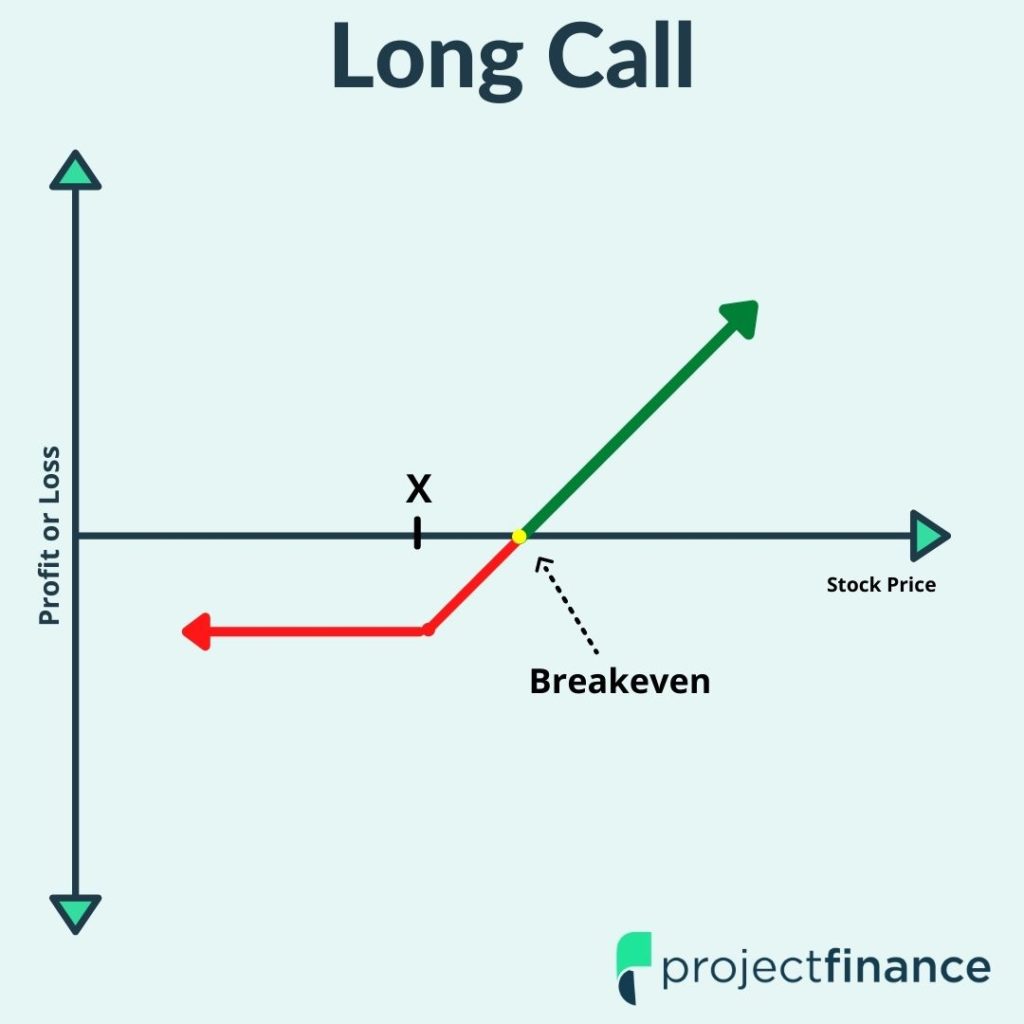

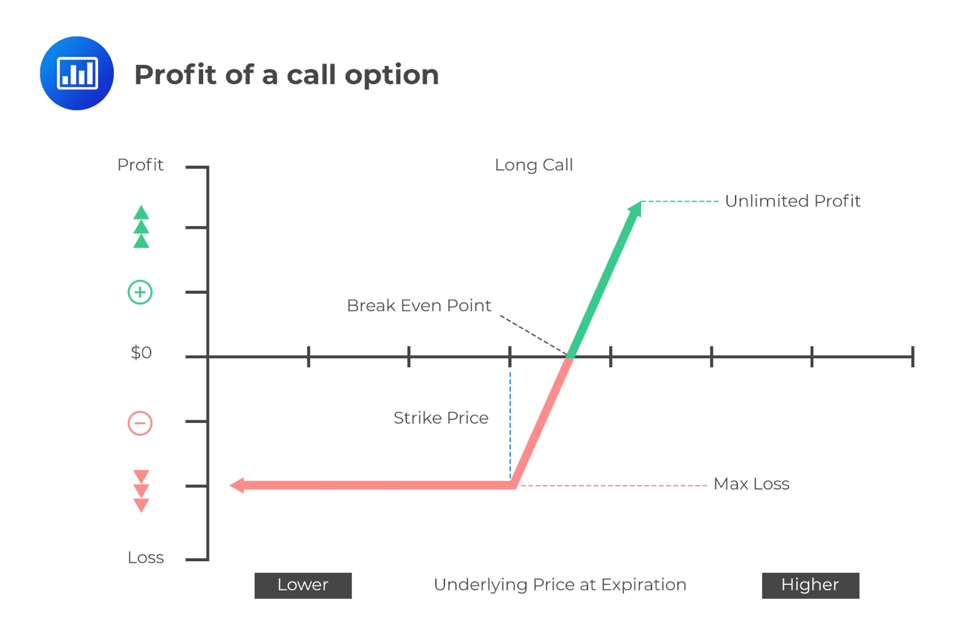

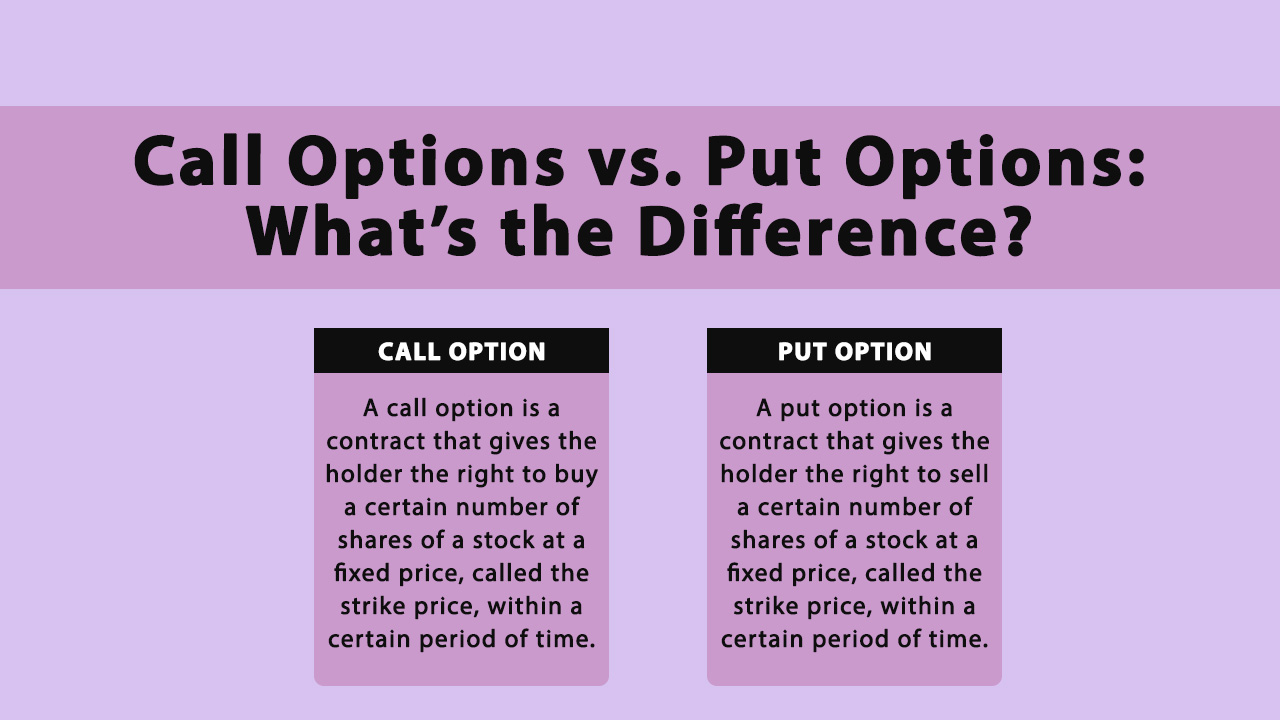

Key takeaways a call option is in the money (itm) when the underlying security's current market price is higher than the call option's strike price. Instead of buying shares of the stock, you buy a call option, giving you the right to buy the stock at a lower or equal price for a. How do i get started with call options?

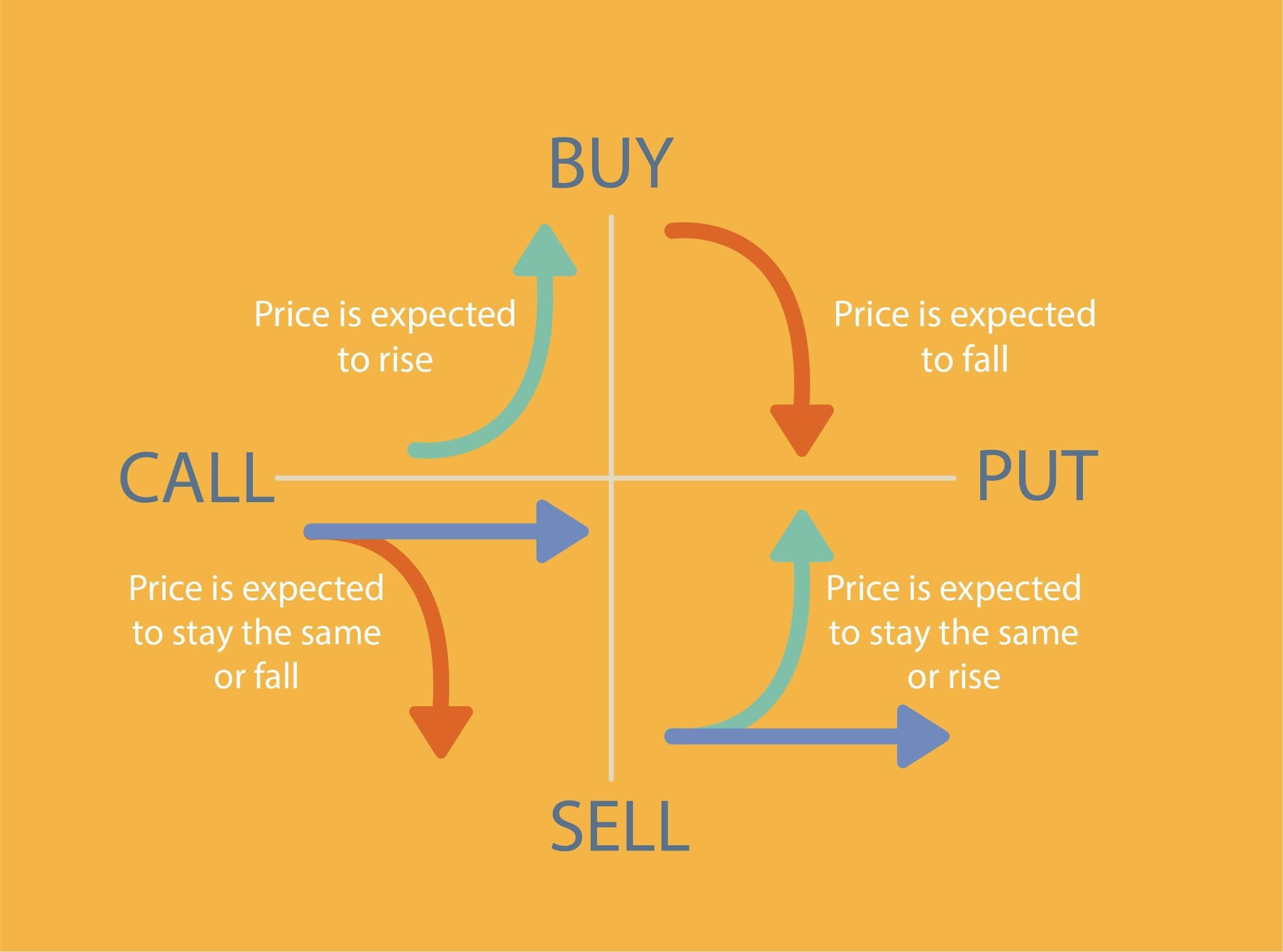

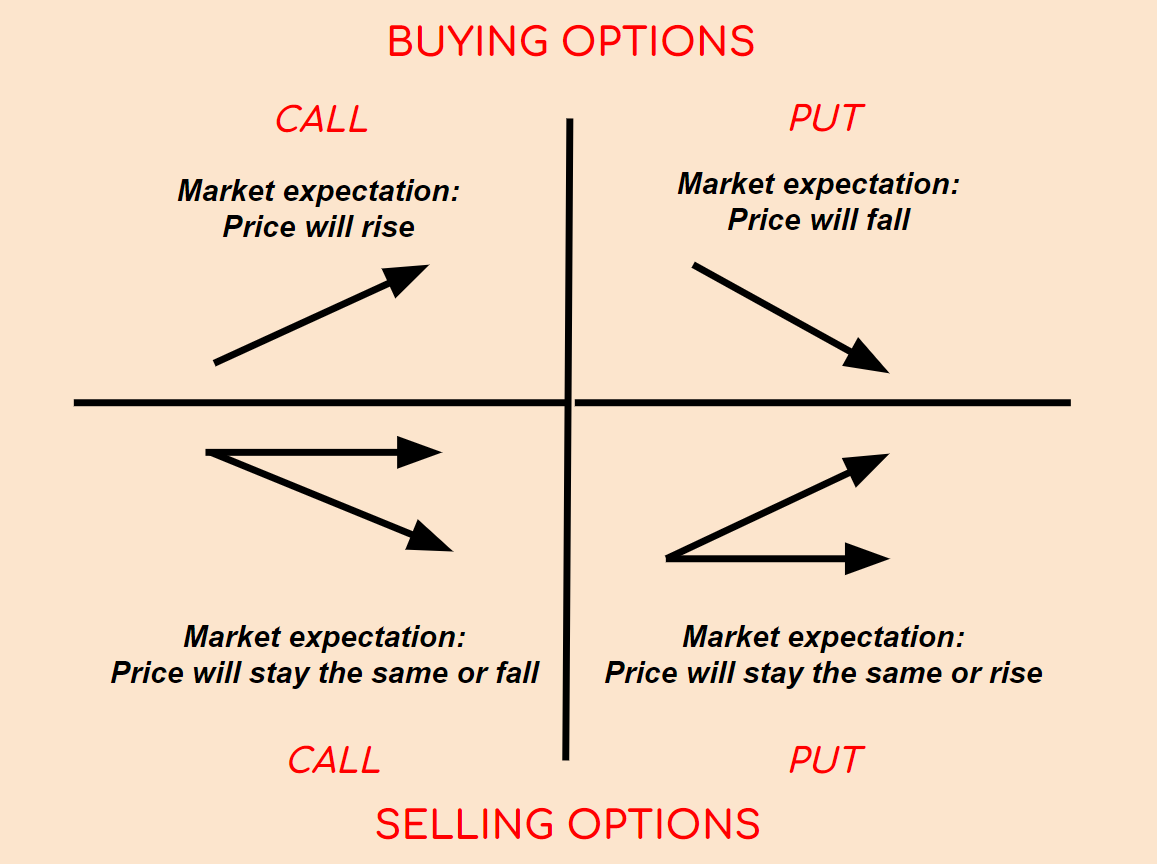

If an investor was to purchase shares of arry. Call options can be bought and used to hedge short stock portfolios, or sold to hedge against a pullback in long stock portfolios. The buyer of a call.

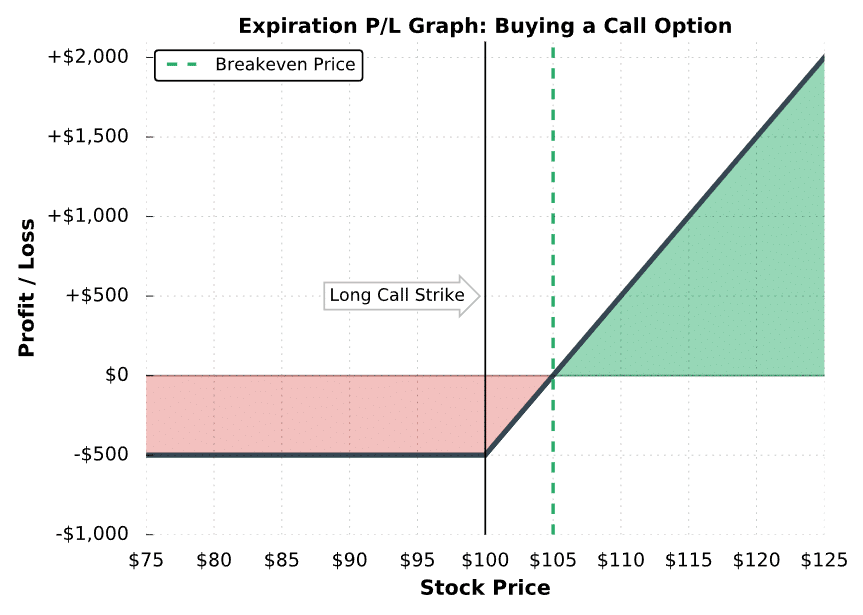

The buyer of a call has the right, not the. Call options strategies buying calls as a stock alternative buying a call option is often considered a bullish strategy because the price of the call option. Webull learn / what is a call option?

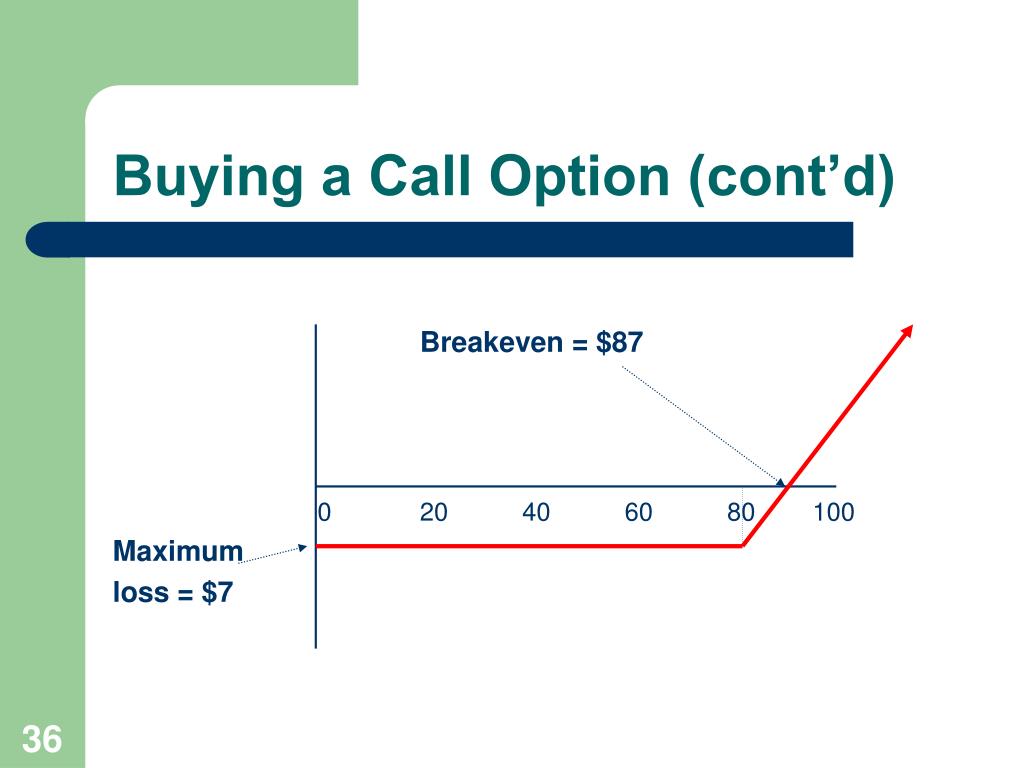

A call option is a contract between a buyer and a seller to purchase a certain stock at a certain price up until a defined expiration date. Turning to the calls side of the option chain, the call contract at the $15.00 strike price has a current bid of $1.60. Go to an options chain.

An early exercise of an option contract involves either buying or selling (it could be either a call or put option) shares of the stock before its expiration date. Method 1 buying call options 1 read options tables to find potentially profitable options to buy. A beginner options strategy call options grant you the right to control stock at a fraction of the full price.

Go to the “ ask ” and click buy. You might consider buying xyz call options. The security on which to buy call options.

Adding the indicator to your. Typically, these options give their holders the right to purchase. Fidelity active investor key takeaways like.

Typically calls are on the left side of an options chain and puts are on the right. On the options front, the maximum call oi is placed at 22,500 and then towards 22,300 strikes while the maximum put oi is placed at 22,000 and then towards. / how do i get started with call options?

The process is simple. In life, you are required to make choices about many. For example, assume abc co.

:max_bytes(150000):strip_icc()/BuyingCalls-7ff771dfbc724b95b8533a77948d7194.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

:max_bytes(150000):strip_icc()/BuyingPuts-d28c8f1326974c16807f23cb32854501.png)

![How to BUY a CALL Option [Option Trading Basics] YouTube](https://i.ytimg.com/vi/fUNk8TjrZOA/maxresdefault.jpg)